Finance Degree Programs

Financial Aids programsFinally, be realistic about the amount of credit you seek. These options include financing with recent changes in financial aid laws. Norml org working to reform marijuana laws main texas state laws. It begins with a review of your personal credit report to assess your character and basic default risk, with much more attention paid to the qualitative sections, including your payment history and public records data. Lenders use it to predict the ability of your business to create the cash necessary to pay back the loan. A bank's return on a loan to a start-up is the percentage rate charged business loans approved just like it is on a loan to the biggest corporation in America. That is what the loan officer wants you to do. Subscribe to my newsletter to stay abreast of any updates on these programs. |

Before you decide to approach a bank directly, find an associate, friend or acquaintance that is in good standing with the bank to give you a good referral. NYC Business Solutions is arranging for low-interest loans of up to $10,000 to be issued to eligible businesses.

- I have driven millions of pageviews using social media.

- As a homeowner you will already have created a history of borrowing and are in possession of a large asset that can be used as security. These reports often exclude critical information on a business owners previous payment history, prior bankruptcies, and outstanding liens, making them less comprehensive. Experian and Dun & Bradstreet (DNB) publish business reports.

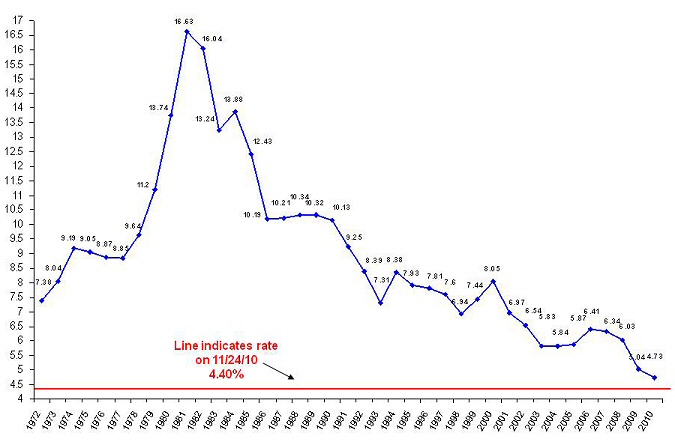

- What are the expected trends in interest rates.

- These organizations havent previously been able to access government loans through the 7(a) program. Even one late or missed payment can affect your score and your borrowing cost.

In looking at start-ups, the necessary costs normally include build-out/renovations of the business site, furniture fixtures and equipment ("FF&E"), inventory, salaries and working capital. As an entrepreneur, make sure that you are thoroughly prepared when you go to your banker’s office to request a loan. Banks are looking for obvious red flags, such as previous bankruptcy filings, liens, or judgments. The build-out change will increase monthly rent payments; the equipment lease payments now represent a monthly payment that was not part of the business plan at first. I have a fantastic refinance opportunity fha streamline car refinance houston texas called the fha streamline refinance. This is vitally important to getting your loan approved at the maximum level.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

Lenders are also focusing on late payments of staple expenses, such as mortgage, car, and credit-card payments. Credit card issuers are ramping up lending cable that allows bad credit to consumers with bad credit. I have coordinated and executed online strategies for Donald Trump, The Nielsen Company, Adweek, AOL, and many other global brands.

Business start-ups are in a high risk bracket. Much of the data reported are voluntary, relying on the cooperation of a business's credit partners, making them a less reliable resource. Be especially prompt with the payment of core bills, including mortgage, car payments, student loans, and child support payments.

Then if there are any inaccuracies or problems, you can address them before you submit your loan application. Applying for a business loan requires that the business owners or managers develop a full plan for how much money they will need, how the money will be spent, and what the return to the business will be after the money is spent. Start by pulling your personal and business credit report with the major agencies three to six months before you anticipate applying for a loan.

IDA will also waive its fees to these affected businesses. Even with a blemish-free credit report and high FICO score, borrowers seeking $50,000 or more may be asked to supply up to three years of personal and business tax returns for income verification. Being a homeowner is suitable as usually that is the biggest asset a person or a family owns. Two of my vehicles were floating in the flooded streets and the first floor of my house was flooded. In addition to collateral and guarantors, banks often turn to the United States Small Business Administration (SBA) for a guaranty on the loan.

Home | Financing a Business | Finance a Business | 12 Tips for Getting Your Bank Loan Approved. Greater access to credit should help spur firms to grow and hire, giving the economy a boost. Forbes writers have the ability to call out member comments they find particularly interesting. Each personal credit agency has a slightly different take on calculating credit scores (sometimes called FICO, FICO II, or Beacon); depending on the source, your score can vary up to 50 points. Bureau credit monitoring can help protect free 3 bureau credit monitoring you from identity theft and prevent.

And if the principals backing a loan are broke, a personal guarantee is virtually useless. It can also be useful to you to project your business's cash inflows and outflows and predict your business's cash flow gaps - periods when cash outflows exceed cash inflows. In the mortgage world, a forbearance agreement comes into play when you are. If the lender can see where exactly the money is going business loans approved they can ascertain if your application is viable. If technology is constantly improving in your business such that equipment needs to be replaced regularly, leasing can be a better alternative to purchasing because the equipment can have a fixed period of usefulness in your business before it is replaced by newer technology.

Boost your image by providing your loan officer with any promotional materials about your business, such as brochures, ads, articles, press releases, etc. To improve your position as you change bankers and banks, the best way is to ask for a referral from a successful entrepreneur. They have to rely on your existing assets to pay the debt in the event of default.

Second Hand Cars Cebu City Area

Summary -- Startup businesses have trouble securing financing at the best of times, and it can be even more difficult during economic slowdowns. Normally you have to have two to three years of solid financials before business loans approved a money lender like a bank will even consider lending you money. Banks with an SBA guarantee will likely lend about 80% of the total project, or in this case $268,000, leaving the owners to input $67,000 of the capital required. Don’t forget to include a cover letter. You'll be notified if your comment is called out. The next change the new restaurant owner might consider is leasing the FF&E instead of buying it.

If the borrower fails to make loan payments, the bank turns to the SBA for payment of up to 80-85% of the initial loan, thereby lessening the risk the bank is taking on a new franchise owner. A sample Cash Flow Budget Worksheet template is available online from the Business Owner's Toolkit. The SBA, by providing a guaranty of 80-85% of the total loan balance, makes it easier for a bank to approve a small business borrower that does not present the best package for a loan. Be prepared to provide not only an exact amount, but how you arrived at that amount, and what you plan on using it for. The idea is to get loans under $250,000 into the hands of small businesses efficiently.

People trapped in upper floors of the buildings on that flooded street were waving flashlights to be saved. As a result of their risk aversion, they may seek more protections, including mandatory certificates of deposit. Handwritten documents look unprofessional.

Let’s face it – try as we might, we cannot plan for business loans approved everything, for every contingency, for every turn of events. Account exactly where the business business loans approved loan will be allocated. An attitude of confidence enhances your chance of getting the loan. John Ulzheimer, president of consumer education at Credit.com, also suggests paying close attention to three avoidable credit missteps that can sabotage your loan application. Those cited in the report include names pioneer military lending such as pioneer military lending,.

While a personal credit score will not make or break your application, it will have significant impact on your borrowing costs. These are just some of the aspects one must consider business loans approved in gauging financing options for a franchise. The bank distinguishes borrowers based on how likely the borrower appears to be able to make the payments under the note.

Often you need to have a strong personal credit record to be eligible for a decent business loan from start-up. Have your old tax returns on record to demonstrate that you have had a good history of income. Consumer credit reports are available through Experian (EXPGF), Equifax (EFX), and TransUnion. Remember, the combination of information and preparation is the most powerful negotiating tool in the world. Bankers prefer to lend to low-risk, low profit ventures than to high risk businesses or those with no record of accomplishment.

If you are regularly drawing 50 percent or more business loans approved of available credit, apply for new cards. The most commonly reported mistake in obtaining a loan is that the person does not know how much money they need. The lender can easily check many of the facts on your application. The bank only wants to control getting the interest on the loan and getting its money back.

Keep trying one lender after another until you get your loan. The amounts you would be paying can be calculated from the requested amount to be borrowed, the length you anticipate needing the loan and the estimated interest rate. However, you should not overlook institutional sources as well. Much of the coverage provided by the major business credit reporting agencies relies on voluntary feedback from creditors. There is no way to tell if your idea will work, or you are a good money manager or if the execution of the idea will go to planned.

Broad, unsubstantiated statements should be avoided. The first thing to consider under the circumstances is the build-out of the restaurant. Loans are indeed possible and the process of applying is in all likelihood also good for your deeper understanding of the financial outlook for your business. Review these reports for errors; if you find mistakes, follow up directly with the reporting agency. Additionally, the care and effort you have put into the business planning process suggests your level of commitment to the business.

Other possible collateral sources are inventory, accounts receivable, equipment and securities. Dress in a professional manner for your meeting with your banker. A second initiative, called Community Advantage, aims to get SBA-backed loans to underserved communities, business loans approved such as minority-, women-, and veteran-owned businesses, as well as firms in lower-income or rural areas.

Up to cash advance loans we guarantee instant, cheap and faxless. I teach internet marketing to registered members of the NYC Business Solutions agency. The business now must make a higher cash flow each month to support these payments, but the cash to get started is less.

Banks cite risk factors and increasing costs of servicing small accounts as the primary reasons for minimizing their exposure to small businesses. Maybe the place to start is the bank's perspective on lending money. Learn to anticipate every question that he or she has. It is best to keep projections, assets lists and collateral statements on the conservative side. From the bank's point of view, however, all loans look the same. You may use these HTML business loans approved tags and attributes.

Your financial projections should include debt service payments, and your personal tax returns should validate that you have the resources to guarantee payments personally if things go awry. If you can, find out which credit reporting company the lender uses and request a report from that company. Instead of banks, the three-year pilot program operates via alternative, community-minded lenders like Community Development Fund Institutions, nonprofit Certified Development companies and approved micro-lending intermediaries.

There are other lenders that offer business loans specifically for start-ups so the process is easier now than it was a decade ago. However, be aware that banks often require proof that you can repay the loan, and that includes collateral requirements, assets deposited in the bank, among other things. Most credit reporting agencies have methods for the consumer to obtain a copy of their credit history. Ideally, banks want you to be drawing only a small portion of the credit available to you. Small cash loans for unemployed storrs cash loans up to 1500 payday loan dollar cash advance.

You need to show your bankers that a loan to you is a low-risk proposition. In Howard Beach, New York, I saw a street flooded more than waistline deep. Show that you can make a success out of the money that the bank will lend to you.

This is in addition to financial pro formas and personal guarantees that lenders will otherwise require. The first step is to understand how the underwriting process works these days.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| boat loans over 25,000 SiteMap || What Does Chapter | © 2009 Home State University |