Finance Degree Programs

Financial Aids programsOnly when you apply for new credit or loans does a “hard inquiry” count against you. These options include financing with recent changes in financial aid laws. If you don’t cancel during the trial period, you may be unwittingly credit report with scores agreeing to let the company start charging fees to your credit card. Monitoring your credit report allows you to stay on top of your credit on a daily basis. It tells them whether its a good bet that youll pay off that big credit card payment or make payments on that new Cadillac right on time. That's why it's so important to stay on top of your credit credit report with scores reports for changes that could affect your credit scores. Product name, logo, brands, and other trademarks featured or referred to within Credit Karma are the property of their respective trademark holders. By submitting a post, you agree to be bound by Bankrates terms of use. |

Even though you want to be a good person, and you want your friend or family member to love you, don’t lend him or her money if you can help it. Make sure your credit information is accurate and check your Experian, Equifax and TransUnion reports side-by-side with Experians 3 Bureau Online Credit Report and Scores.

- You have three FICO scores, one for each of the three credit bureaus.

- We provide truly free credit scores to consumers direct from the credit bureau and show how you can save money on your credit cards, loans, mortgage and more. When you order your $1 Credit Report and Score here, you will begin your 7-day trial membership in freecreditreport.com. I personally managed to cut credit report with scores my monthly expenses by. A new customer welcome letter is a valuable part of acquiring new clients, especially if your business is one that focuses on personal relationships.

- The higher the credit score, the lower the risk.

- Includes unlimited online access to your Experian credit report and score. Contrary to popular belief, checking your own credit credit report with scores reports will not hurt your credit scores. Credit.com helps you compare and choose quickly, by providing easy-to-read reviews, side-by-side comparisons, and expert analysis to make selecting the best credit score, report, monitoring or identity theft protection product easy.

Any acceptance is exclusively the choice of a Credit Partner. In addition, each report must contain at least one account that has been updated in the past six months. Pulling your own credit report counts instead as a “soft inquiry” and has no impact on your credit scores. As a top credit reporting agency, we are dedicated to helping people get their credit reports, find out their credit scores, prevent identity theft, manage their credit rating, become educated on basic consumer credit information and control the economic aspects of major life events. A little insight into the credit reporting bad credit sucks process will help you understand why. In general, when people talk about "your score", theyre talking about your current FICO score.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

The following statuses, either open or paid, credit report with scores are considered potentially negative. If you request your report online at annualcreditreport.com, you should be able to access it immediately. Experian also strives to help companies develop a credit history, manage credit risk, prevent fraud and grow their business with targeted mailing lists.

When you apply for credit – whether for a credit card, a car loan, or a mortgage – lenders want to know what risk they'd take by loaning money to you. FICO® scores are the credit scores most lenders use to determine your credit risk. As this information changes, your credit scores tend to change as well. Lenders use credit scores to help them determine the "credit worthiness" of consumers applying for credit cards, lines of credit, or loans. Your browser does not have Javascript enabled.

America s marketplace to buy, sell, or rent mobile or manufactured homes. These days, credit scores and credit reports are a very important way for lenders to measure your credit behavior. Time to go green, save the paper for the planet ” Learn More. They want a credit report 1st to verify he’s not an illegal – then interview. A low score means you have a history of not doing such a great job of paying back your debts.

Some of these “imposter” sites direct you to other sites that try to sell you something or collect your personal information. The form is on the back of this brochure; or you can print it from ftc.gov/credit. Each of record of previous and current credit and loan records will show your payment history going back 7 years, along with other account details like credit limit, when the account was established, the type of account (installment, revolving,), etc. Only one website is authorized to fill orders for the free annual credit report you are entitled to under law — annualcreditreport.com. Try freecreditreport.com RISK-FREE for 7 days and get your.

But no score says whether a specific individual will be a “good” or “bad” customer. Get the cheapest auto insurance quotes using our free rate finder tool. LIKE NEW ROOF AIR CONDITIONER COVER(COLMAN BRAND)(FITS MOST R.V.A.C'S - $40 (SANTA FE) pic. Your creditors will do their best to ensure that you won’t get overextended.

You can convert your fixed price listings note. With our credit simulators, free credit scores, credit advice, and credit score comparisons, our goal is to empower consumers to more actively manage their credit and their financial health. Apply here and get personal loans for bad credit, here you can get approved to.

I just found out last week that I’ve exhausted all of my unemployment benefits. Calculated on the PLUS Score model, your Experian Credit Score indicates your relative credit risk level for educational purposes and is not the score used by lenders. Experian® prides itself on being a leader in credit education. DID YOU KNOW that three little numbers (your credit score) could end up saving you hundreds, or even thousands, of dollars.

The FCRA promotes the accuracy and privacy of information in the files of the nation’s consumer reporting companies. Some employers even check prospective employees’ credit reports before making final hiring decisions. To order, visit annualcreditreport.com, call 1-877-322-8228, or complete the Annual Credit Report Request Form and mail it to. Otherwise, a consumer reporting company may charge you credit report with scores up to $11.00 for another copy of your report within a. Credit reports are the files that credit report agencies maintain about your credit history and share with the rest of the world.read more.

If an investigation doesn’t resolve your dispute with the consumer reporting company, you can ask that a statement of the dispute be included in your file and in future reports. Another way to stop the sale and possibly keep your house is to file bankruptcy. Credit scores are calculated based on data in your credit reports and, as fluid numbers, change over time, sometimes on a daily basis.

A high score means you're a good candidate to pay back a loan – on time. In some cases, the “free” product comes with strings attached. So if you're wondering, "What is my credit score." you can view your credit score here or learn more about credit scores in the Credit Education Center. The FTC works to prevent fraudulent, deceptive and unfair business practices in the marketplace and to provide information to help consumers spot, stop and avoid them.

The data that each of the "Big Three" accumulates are the meat and potatoes of your credit report – any one piece of data can mean the loss of a home loan or the rejection of a credit card application due to weak credit. Lendingqb automated underwriting and loan pricing engine. This forced banks and student lending organizations into competition with each other, ultimately causing them to offer competing interest rates, as well as other perks and discounts in order to attract customers. Getting your Credit Report & Credit Score is the first step in knowing your credit. You can check your credit reports as often as you’d like.

Checks Unlimited

That’s not to say that the information in any of your reports is necessarily inaccurate; it just may be different. The three credit bureaus, TransUnion, Equifax and Experian, developed VantageScore to improve the consistency, accuracy and predictive quality of consumer credit scores, and to enable more consumers with limited credit histories to receive a credit score for the first time when credit checking. Experian provides consumers and businesses with the information credit report with scores they need to make better financial decisions. Click Here for important product disclosures, limitations, restrictions and conditions that may apply. At Credit Karma™, we believe free access to one's credit score and report is a fundamental consumer right. Register to win over k of quickbooks new to quickbooks software www quick training com free.

Get Fast Cash Loan Now In Philippines For Students

That score indicates whether you're a god credit risk or not. Because nationwide consumer reporting companies get their information from different sources, the information in your report from one company may not reflect all, or the same, information in your reports from the other two companies. Days ago today is employee appreciation day. Experian and the Experian marks used herein are service marks or registered trademarks of Experian Information Solutions, Inc. Know what's in your Experian credit report and who's been checking your credit and why. A credit report includes information on where you live, how you pay your bills, and whether you’ve been sued or arrested, or have filed for bankruptcy.

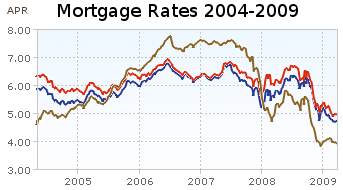

Therefore, monitoring your credit report and score has never been more important. Apr mortgage rates have mortgage rates at 2.5 never been lower. Ask Experian is the credit reporting industry s first online consumer credit advice column.

In addition, despite increased public awareness of identity theft, the crime continues to grow. Consumers' Credit Reports Hacked in 2011 Breach. If you don't cancel your membership within the 7‑day trial period*, you will be billed $17.95 for each month that you continue your membership.

For your three FICO scores to be calculated, each of your three credit reports must contain at least one account which has been open for at least six months. Dollar bad credit personal loans in hi, fla, la, gu loans for bad credit. Your 3 FICO scores affect both how much and what loan terms (interest credit report with scores rate, etc.) lenders will offer you at any given time. There are plenty of ways to determine citizenship besides a credit report… and we recently reported that some companies are getting in trouble for this practice. Credit Karma is a registered trademark of Credit Karma, Inc.

You also can ask the consumer reporting company to provide your statement to anyone who received a copy of your report in the recent past. Since its introduction 20 years ago, the FICO Score has become a global standard for measuring credit risk in the banking, mortgage, credit card, auto and retail industries. When the investigation is complete, the consumer reporting company must give you the written results and a free copy of your report if the dispute results in a change. FICO scores provide the best guide to future risk based solely on credit report data.

Copyright© 2007-2012 Credit Karma™, Inc.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| boat loans over 25,000 SiteMap || Used Car Auction | © 2009 Home State University |