Finance Degree Programs

Financial Aids programsThe only way to know where one stands is to apply for the loan and speak to a professional specializing in mortgage loans. These options include financing with recent changes in financial aid laws. Cash advance loans online payday loans available from speedy cash. The problem is we have little equity, and my credit isnt great. Thats why our goal is to keep you informed on trends in the marketplace using the latest statistics in your local area. I mean, I can't tell you exactly how it works, but I was poor credit home loans told that Steven personally saw both of my films. An FHA mortgage can get you into a new home — even if you have bad credit — because the loans are insured by the federal government. It still may be possible for lenders to give you a loan, provided your credit score is not too low. |

Youll be notified if your comment is called out. Our FHA speitts are ready to work with you to turn your dream of owning a home into reality.

- Home loans do exist for people with poor credit.

- Line breaks and paragraphs are automatically converted - no need to use <p> or <br> tags. Would your customers benefit from a free mortgage calculator on your website. If the borrower is unable to pay the whole balloon payment, they must refinance, sell, or lose the house.

- The scores are determined by looking at the following data.

- Sub-prime rates will be higher, but it is the credit score that determines how high. We went to this company called We Rent For You Leasing Solutions, and they helped me and my wife out.

A copy of the order appointment order can be found here. Newly established businesses may have few assets or assets that are difficult to value as collateral. Please note that this cannot be arrived at simply by multiplying the payment amount by the number of payments remaining. Cancellation of your homeowner’s insurance coverage by your insurer is allowed within the first sixty days from the time the policy is issued in a case that undisclosed risk of loss is discovered which is not related to a prior claim, fraud or increased risk are discovered or you have not paid your premium. Semi truck financing i need help refinancing my home with bad credit how to get. Thank you for visiting our website - please consider it as your online source for local Real Estate information, and return often for the latest property listing updates.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

And I can’t seem to find anywhere online the New Jersey law for interest accrual. Ask your friends, family, real estate professionals for a recommendation of an experienced Mortgage Loan Officer - one who specializes in working with those who have credit issues. David was authorized to send the power transformer to the buyer pursuant to their agreement.

Your bank will have the best interest rate you can possibly imagine and will give you the best possible deal. There are many home loan companies where a consumer who is already having bad credit profile can get a home loan very easily. Bonds back to top credit week focus provided by standard and poor's credit market services group, credit week offers a thoughtful look at the global credit markets, providing credit rating news analysis.

Lisa Rudden, Gary Rudden, Rick Reed, and Nick Bobruska have created a business model that benefits the consumer. Video Shows Gas Thief Setting Self on Fire, Crashing Truck Into Home in Mesa, Ariz. Even after you reverse the downward spiral of your credit history, you might need to tell a prospective lender that there may be some signs of bad credit in your report. This option would repeal the 2010 health care reform legislation in its entirety. I want to use this medium to inform you that we render reliable beneficiary assistance as I`ll be glad to offer you a loan.

Our Team was founded in November 2004 by four Real Estate Professionals with extensive ties to the local community and over 50 years of combined experience. Vanderbilt Mortgage has the most ruthless and the nastiest people (Loan Officers/Collection Reps) working for them. Lenders, however, must consider many factors in a particular process that is called “risk-based pricing,” which is when they determine the terms and rates of the mortgage. Eat in Kitchen - Nice LR - No Carpet - Single Garage - $695 / 3br - (Horn Lake, MS) pic. E-LOAN connects you with one of our trusted lending partners, so you can compare rates and terms to find the loan that’s right for you.

Courts have time sensitive response deadlines. Very good conditions Ready to move in Won't last Don't forget to ask about units in Bronx, Queens, Manhattan, Brooklyn & Westchester If you have bad credit we can help you to repair. If you’ve had a bankruptcy that’s 2 or more years old, but have reestablished your credit with a clean payment history over the last 12 months, you might qualify for a VA loan. Many people are afraid that they are going to be stuck, forever, as renters. FHA mortgages can work — even if you have bad credit — because they are fully insured by the federal government.

Let's work together to buy or sell your next home. Loans insured by the Federal Housing Authority (FHA) are designed to help everyone realize the dream of owning a home. In 2008, CompuCredit agreed to return more than $114 million to customers after the Federal Trade Commission accused the company of deceptive practices that included failure to disclose high credit-card fees and failure to tell customers that accepting a Majestic credit card—emblazoned with a Visa Inc. This checklist will itemize all of the items you must submit to your loan officer before receiving a loan commitment.

Documents may include (but are not limited to) W-2 forms, pay stubs, credit reports, and bank statements. Luxury apartment rentals in houston, great apartments, tx tampa and other u s. Your credit bureau will attempt to get the disputed items deleted from your report by contacting the creditors involved. Scores between 620 and 650 indicate that a person has good credit, but does indicate poor credit home loans there might be potential trouble that the creditors may want to review. There are lenders that do poor credit home loans out there that are not banks or institutions.

They may not be able to work with you if you have poor credit, but you must try first because they will also be able to give you advice on how to get a home loan if you cannot get one through them. To leave another comment, just use that password. The bad credit mortgage is often called a sub-prime mortgage and is a type of mortgage that consists of homebuyers with low credit ratings.

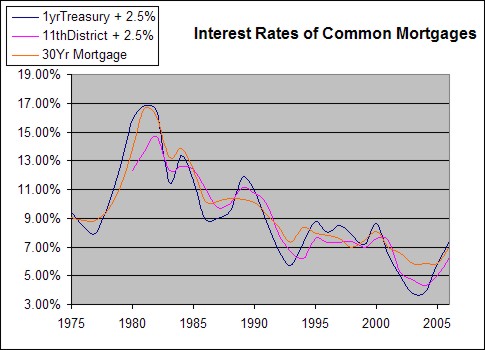

The application takes only 1-minute and is safe and secure. And with one-third of Americans having FICO scores under 620, you have a lot of company. After the Plan has been confirmed by the court, the plan canonly be modified with court approval. And they’re ideal for first-time home buyers. Subprime have interest rates that are higher than prime loans.

Mortgage lenders look at the "age," dollar amount, and payment history of your different credit lines. If it’s a new mortgage, you’ll then take possession of your new home. You can put up to 3 URLs in your comments. Items that are just plain erroneous can stay on your poor credit home loans report for up to 10 years if they are not disputed. Lenders often charger higher interest rates on sub-prime mortgages in order to compensate for the high risk that they are taking.

Creditors see this number as an indication of whether or not an individual will repay money that is loaned to them. Do you already know that you have poor credit and are going to struggle to get a home loan. Refinance rates provided by hsh com logo can mean your interest rate on a home loan will be percentage points lower than someone with a score. Our loan interest rates are very low and affordable with a negotiable duration.

Graduate Private Loan

It is very important to appear in court on the scheduled date. It doesn't matter what the reason for the Poor Credit Home Loans is, you will be approved. However, it is overall creditworthiness that is not just determined by credit scores. We’ve combined the speed and ease of the Internet with the hands-on help our customers expect. Sub-prime loans are very likely to have a balloon payment penalty, pre-payment penalty, or penalties for both. Find out what you need to do to repair bad credit and rebuild your credit score.

After 30 days, if the creditors do not respond, the item is deleted from the report. Processing an FHA loan involves gathering documents to verify the information in your application. We'll process your information and notify you immediately of the status. In addition to cleaning up your debts, you also need to check your credit report to make sure it is accurate.

Auto Loans 100 Accepted

There are many options out there for poor credit home loans that will help you. The last option is to use a non conventional lender. The higher the number is, the better the score. As a result, it will allow you to tackle your principal more with each payment, thereby allowing you to pay off the bill faster. Your deposits are insured up to $250,000 per depositor. This will save you time, since he will look at different loans than he might otherwise.

Many people would like to own their own homes, but are deciding to rent before even speaking with a mortgage speitt. At the closing, you will sign all of poor credit home loans the required mortgage documents. Bad credit home loans for people that have suffered from credit problems in the. Following are five tips on how you can improve your chances of getting a loan if you have bad credit. Because these loans are insured by the federal government, more people qualify for FHA loans than for traditional ones.

If you don’t pre-qualify right away, your loan officer will suggest ways to improve your profile, so you may become eligible in the future. We’ve worked with many people who were afraid that they had “bad credit” — but who are now homeowners. Good communication with your loan officer will increase your chances of pre-approval and speed the processing of your loan. Custom shelving with integrated tie downs protects equipment during transport and maximizes space.

My husband and I are splitting up and the lawyers say I have to refinance our home into my name. By disputing it, you put the wheels in motion to clean up the report and get a better mortgage. Apply for a loan today with your loan amount and duration, Its Easy and fast to get. Visit www fastrackautoloan com 100 accepted auto loans to get guaranteed auto loan. Bad credit home loans do not have to equal high interest or high payment home.

Free Eviction Notice

There are also other determining factors like what kinds of delinquencies are recorded on the borrower’s credit report and the amount of the down payment. The material on this site should not be used, copied, stored or transmitted outside of normal use without prior written consent of MyFHA.net, Inc. Do you need a loan and you have bad credit. Because the FHA insures these mortgages, FHA lenders can work with borrowers regardless of credit problems, poor credit home loans collections, past bankruptcy filings, or debt-to-income ratios that are higher than normally allowed. Are there commercial hard money lenders in poor credit home loans Michigan who are currently lending money. Even if you’ve had accounts forwarded to collections, have filed bankruptcy in the past, or have high debt, you still may qualify to refinance.

Having bad credit is not the end of the world. That means opening accounts frequently, running up your balances, and paying on time or not at all can impact your credit score negatively. When scores are below 620, the consumer may find that they can still acquire a loan, but the process will take longer and involve many more hurdles. Below this number indicates a greater credit risk, so more aspects have to be reviewed. Just changing one of these components of your spending behavior can positively affect your credit score.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| boat loans over 25,000 SiteMap || Average Credit | © 2009 Home State University |