Finance Degree Programs

Financial Aids programsLenders can apply for a COE online at www.benefits.va.gov/homeloans/docs/Veteran_registration_coe.pdf. These options include financing with recent changes in financial aid laws. Even with bad credit, installment loans are available from ace cash express. It is a Federal crime punishable by fine or imprisonment, or both, to knowingly make any false statements on a VA loan application under the provisions of Title 18, United States Code, Section 1001, et seq. If this happens, meeting college savings goals can become more difficult. If approved, all interest currently due on the loan the veteran home loan must be paid, and a new six-month loan is written. Failure to register in a timely manner can result in jeopardizing a student’s visa status, leading to possible deportation and ineligibility to re-enter the United States. But it specifically provides that occupancy by the veterans spouse satisfies the personal occupancy requirement. |

For refinancing loans, most closing costs may be included in the loan amount. The guaranty amount is what VA could pay a lender should the loan go to foreclosure.

- Additionally, Congress raised VAs maximum loan guaranty for these types of refinancing loans.

- For all types of loans, the loan amount may include this funding fee. If a Veteran allows assumption of a loan without prior approval, then the lender may demand immediate and full payment of the loan, and the Veteran may be liable if the loan is foreclosed and VA has to pay a claim under the loan guaranty. A release of liability does not mean that a the veteran home loan Veteran's guaranty entitlement is restored. A veterans maximum entitlement is $89,912, and lenders will generally loan up to four times your available entitlement without a down payment, provided your income and credit qualifications are fine, and the property appraises for the asking price.

- You are not eligible for VA financing solely based upon service in World War I, Active Duty Training in the Reserves, or Active Duty Training in the National Guard.

- VA Home Loans are available for a variety of purposes including building, altering, or repairing a home; refinancing an existing home loan; buying a manufactured home with or without a lot; buying and improving a manufactured home lot; and installing a solar heating or cooling system or other weatherization improvements. A VA funding fee of 0 to 3.15% of the loan amount is paid to the VA; this fee may also be financed.

Local listing agents through local Multi Listing Systems (MLS) list the properties. If you have a service connected disability that you are compensated for by the VA or if you are a surviving spouse of veteran who died in service or from service connected disabilities, the funding fee is waived. Many veterans use their VA Home Loan Certificate of Eligibility to negotiate in good faith a private home construction loan and then refinance the completed home using VA Home Loans. When refinancing a VA-guaranteed loan solely to reduce the interest rate, a Veteran need only certify to prior occupancy. Private mortgage insurance (PMI) guarantees conventional home mortgage the veteran home loan loans - those that are not guaranteed by the government. A thorough inspection of the property by a reputable inspection firm may help minimize any problems that could arise after loan closing.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

Veterans can have previously-used entitlement "restored" to purchase another home with a VA loan if. Over the history of the program, 18 million VA home loans have been insured by the government. If you do not have this Certificate, you will need to apply using VA Form 26-1880 and this will require a copy of DD-214 (Certificate of Release or Discharge from Active Duty) showing character of service.

Repo Cars For Sale

In a purchase, veterans may borrow up to 103.15% of the sales price or reasonable value of the home, whichever is less. A funding fee must be paid to VA unless the Veteran is exempt from such a fee. The government simply guarantees loans made by ordinary mortgage lenders (descriptions of which appear in subsequent sections) after veterans make their own arrangements for the loans through normal financial circles. General questions about VA loans that may arise before you get one. That occurs only if the borrower is an eligible Veteran who agrees the veteran home loan to substitute his or her entitlement for that of the seller. Loans for the loan limit or less are typically available to Veterans with no downpayment; loans for more than the loan limit generally require downpayments.

No loan can be guaranteed by VA without first being appraised by a VA-assigned fee appraiser. VA does not endorse and is not responsible for the content of the linked Website. Well maintained ranch home in the township. As you pay off the credit line, the amount you pay is added to the amount available to borrow.

As of 1 January 2012, the maximum VA loan amount with no down payment is usually $625,500, although this amount may rise to as much as $1,094,625 in certain specified "high-cost counties".[1] VA also allows the seller to pay all of the veteran's closing costs as long as the costs do not exceed 6% of the sales price of the home. However, with the enactment of the Veterans Home Loan Program Amendments of 1992 (Public Law 102-547, approved 28 October 1992), program eligibility was expanded to include Reservists and National Guard personnel who served honorably for at least six years without otherwise qualifying under the previous active duty provisions. To qualify for a VA home loan, a Veteran or the spouse of an active-duty Servicemember must certify that he or she intends to occupy the home. The loan may be issued by qualified lenders. Property Management and Miscellaneous FAQs.

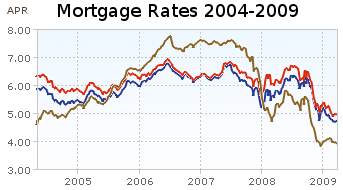

These provisions apply only to a manufactured home that will not be placed on a permanent foundation. These changes will allow more qualified Veterans to refinance through VA, allowing for savings on interest costs and avoiding foreclosure. The maximum VA loan guarantee varies by county. Interest rates are negotiable between the lender and borrower on all loan types. Pay less on what you borrow with current market rate for car loans loan interest rates for mortgages, home.

This often occurs with active duty borrowers who PCS to a new station but want to keep their existing home for retirement. To save time it is important for you to understand that this question is intended to include the following three questions. The VA funding fee and up to $6,000 of energy-efficient improvements can be included in VA loans. Code as was the case for the Iraq/Afghanistan. Manuals & Regulations | Reports & Surveys | If You Owe VA Money | GovBenefits.gov.

Get Your Free Approval by filling out the Easy Online Application or call 800-275-937 to speak to a Zeus Mortgage Loan Officer today. An eligible borrower can use a VA-guaranteed Interest Rate Reduction Refinancing Loan to refinance an existing VA loan to lower the interest rate and payment. It is not an inspection and does not guarantee the house is free of defects.

VA guarantees the loan, not the the veteran home loan condition of the property. Such personnel are required to pay a slightly higher funding fee when obtaining a VA home loan. You can have previously-used entitlement "restored" one time only in order to purchase another home with a VA loan if the borrower has paid off the prior loan but still owns the property, and wants to use his entitlement to purchase a second home. While it appears that it would be harder to get a student credit card get plastic if you are a student, it looks.

Free download pay stub template canada files at software informer this is a. These acquired properties are marketed through a property management services contract with Ocwen Federal Bank FSB, West Palm Beach, Florida. A private lender makes a VA-guaranteed manufactured home loan. However, the seller may pay these on behalf of the VA borrower. A completed VA Form 26-1880 and any associated documentation should be mailed to Atlanta Regional Loan Center, Attn.

Individuals who completed less than 6 years may be eligible if discharged for a service- connected disability. Low pupil-teacher ratios, an International Baccalaureate Program and strong community support all contribute to the quality of education that students receive. There are also no monthly mortgage insurance premiums to pay, limitations on buyer's closing costs, and an appraisal that informs the buyer of the property value.

Lenders decide if they need and want private mortgage insurance. Veterans who had a VA loan before may still have "remaining entitlement" to use for another VA loan. VA will insure a mortgage where the monthly payment of the loan is up to 41% of the gross monthly income vs.

Blu Homes

Questions about who is eligible for a VA loan and reuse of eligibility for another VA loan. Lenders may require that a combination of the guaranty entitlement and any cash down payment must equal at least 25 percent of the reasonable value or sales price of the property, whichever is less. The terms and requirements of VA farm and business loans have not induced private lenders to make such loans in volume during recent years. A list of properties for sale may also be obtained from Ocwen's website at http. Currently annual adjustments may be up to two percentage points and six percent over the life of the loan. VA's guaranteed home loans have no maximum loan amount, only a maximum guaranty amount, which is set forth in law.

If the rate remains fixed for less than five years, the rate adjustment cannot be more than one percent annually and five percent over the life of the loan. Learn what is the difference between a types of debt consolidation secured and an unsecured loan in order. They have been charged with racketeering and multiple counts of obtaining money under false pretenses – with the veteran home loan their bond set at $3.5 million apiece – and could face up to 20 years in prison if convicted of the crimes. VA Home | Privacy | FOIA | Regulations | Web Policies | No FEAR Act | Site Index | USA.gov | White House | National Resource Directory | Inspector General. In addition, reservists and National Guard members who were activated on or after August 2, 1990, served at least 90 days and were discharged honorably are eligible.

Veterans of the Gulf War era — Aug. Along with the Certificate of Eligibility, loan applicants will need to document their credit, savings and employment information. We finance any kind of tractor trailer truck, tractor trailer fianancing whether you re buying from a private.

For refinancing loans, all such costs may be included in the loan, as long as the total loan does not exceed the reasonable value of the property. Typically, no credit underwriting is required for this type of loan. VA also performs personal loan servicing and offers financial counseling the veteran home loan to help veterans having temporary financial difficulties. The cause of ankylosing spondylitis is not known.

Instead, it uses the original purchase price of your home, or the most recent appraised value, as its valuation point. An eligible active duty Servicemember should obtain and submit to the VA Eligibility Center a statement of service signed by an appropriate military official. Call us at (305) 638-7828 and we will contact you with more details. Questions about VA-owned homes for sale, etc. However, no other fees, charges, or discount points may be included in the loan amount for regular purchase or construction loans.

Also, veterans who have used a VA loan before may still have remaining entitlement (see chart) to use for another VA loan. Being responsible and maintaining your credit is key is building a solid rating and acquiring the best rates on all types of financing. They can re-use their VA eligibility for every home purchase from the first to the last. Until 1992, the VA loan guarantee program was available only to veterans who served on active duty during specified periods.

Credit Card Laws

The law requires that you certify that you intend to occupy the property as your home. For a hybrid ARM with an initial fixed period of five years or more, the initial adjustment may be up to two percent. Compensation and Pension | GI Bill | Vocational Rehabilitation | Home Loans | Life Insurance | Survivors' Benefits | Regional Office Homepages. The VA funding fee can be financed directly into the maximum loan amount for the county in which the home is located. Today I had my first appointment with Dr. The basic intention of the VA direct home loan program is to supply home financing to eligible veterans in areas where private financing is not generally available and to help veterans purchase properties with no down payment.

Home loan entitlement is generally good until used if a person is on active duty. At the time of publication, VA's authority to guarantee adjustable rate mortgages and hybrid adjustable rate mortgages was set to expire on Sept. The VA can make direct loans in certain areas for the purpose of purchasing or constructing a home or farm residence, or for repair, alteration, or improvement of the dwelling. Questions about the physical condition of the home, building a home, and its appraised value. Although it's preferable to apply electronically, it is possible to apply for a COE using VA Form 26-1880, Request for Certificate of Eligibility.

The term of the loan may be for as the veteran home loan long as 30 years and 32 days. Closing costs such as VA appraisal, credit report, loan processing fee, title search, title insurance, recording the veteran home loan fees, transfer taxes, survey charges, or hazard insurance may not be included for purchase home loans. When it comes to collecting credit card debt, texas laws impose extreme.

Once discharged or released from active duty before using an entitlement, a new determination of their eligibility must be made based on the length of service and the type of discharge received. A funding fee must be paid to VA unless the veteran is exempt from such a fee because he or she receives a minimum of 10% VA disability compensation. An eligible borrower who wishes to obtain a VA-guaranteed loan to purchase a manufactured home or lot can borrow up to 95 percent of the home's purchase price.

For most loans on new houses, construction is inspected at appropriate stages and a 1-year warranty is required from the builder. You don’t need to worry about intrusive questions or embarrassing interviews. Insurance auto auctions, inc iaa is a salvage auction leader in total loss and commercial. On October 26, 2012, the Department of Veterans Affairs announced it has guaranteed 20 million home loans since its home loan program was established in 1944 as part of the original GI Bill of Rights for returning World War II Veterans. Be aware that different lenders have different closing costs and other fees, so it pays to shop around.

Prequalify for a down va loan with the speitts at veterans united home. Choose a VA-approved lending institution that can handle your home loan.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| boat loans over 25,000 SiteMap || Auto Loan Form | © 2009 Home State University |